Using funding from Freddie Mac’s Small Balance Loan (SBL) program to borrow $1 million to $7.5 million for the purchase or refinance of multifamily properties offers several advantages for borrowers, including flexible loan sizes, lower interest rates, protection from lenderThe person or party (such as a bank or corporate entity) that loans money on a commercial real estat... recourse, and favorable terms.

One of the major benefits of the SBL program is that it may permit borrowers to achieve higher debt leverageThe process of using debt as a funding source in real estate financing, usually as a strategy to pur... than alternative sources of credit. Like all lenders, however, the amount of leverage that a borrower can achieve is limited by Freddie Mac’s multifamily lending underwriting provisions. Perhaps the most important of these is the Loan-to-Value (LTV) ratio.

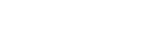

The LTV is calculated by comparing the principal amount of the loan to the appraised market value of the asset being purchased. The formula for the LTV ratio is mortgage amount / appraised property value and is expressed by a percentage. Borrowers who increase their down payments and therefore lower the total mortgage amount give themselves lower LTV values, which can often translate into better loan terms and interest rates.

For example, if a property is appraised at $1 million and a borrower is able to make a $200,000 down payment on it for a total mortgage of $800,000, the LTV would be: $800,000 / $1 million = 0.80 or 80 percent.

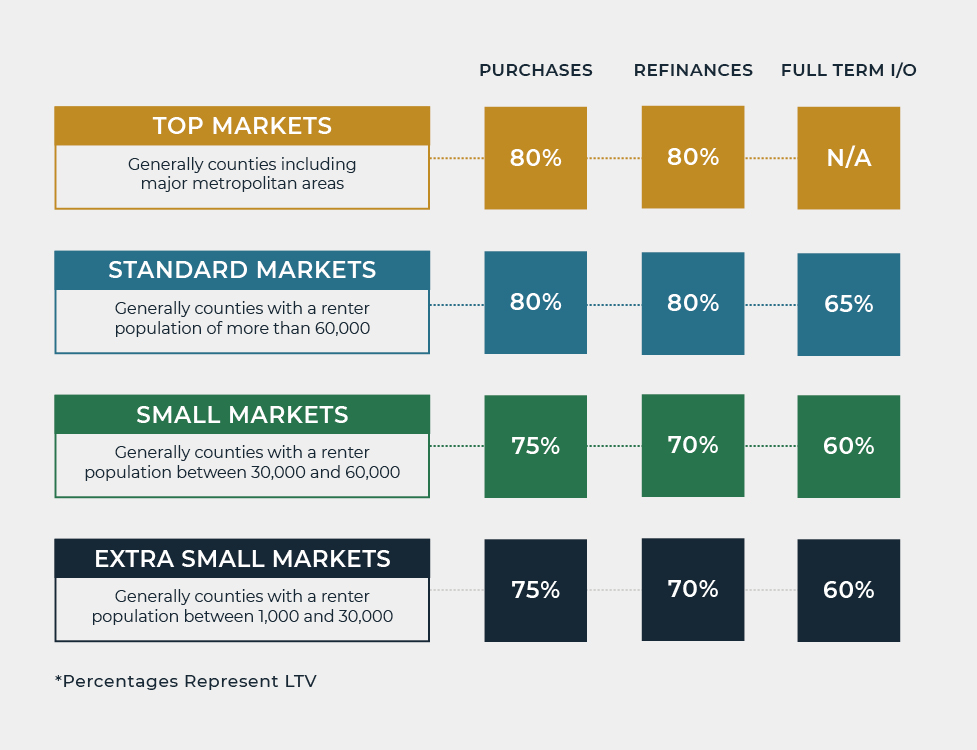

Freddie Mac’s SBL program provides for LTVs up to 80 percent, and full-term interest only (I/O) options; however, these allowances are constrained as follows:

- Top Markets (generally counties including major metropolitan areas): 80 percent for purchases and refinances

- Standard Markets (generally counties with a renter population of more than 60,000): 80 percent for purchases and refinances, 65 percent for full-term I/O

- Small Markets (generally counties with a renter population between 30,000 and 60,000): 75 percent for purchases and 70 percent for refinances, 60 percent for full-term I/O

- Very Small Markets (generally counties with a renter population between 1,000 and 30,000): 75 percent for purchases and 70 percent for refinances, 60 percent for full-term I/O

While important, LTV is only one factor influencing the maximum size of a Freddie Mac SBL. LTV, DSCR, and I/O are all important metrics when considering financing options for buying an apartment building. Minimum Debt Service Coverage Ratio (DSCR) levels, for example, also serve to constrain loan sizing and likewise are subject to market size limitations. The SBL program also includes affordable restrictions, including Land Use Restrictive Agreement contracts, state, county, and local rental assistance programs.

Please contact your Lument representative to find out more about Freddie Mac’s SBL program and whether it might be a good fit for your real estate investment needs.

A quote for your next multifamily investment is just seconds away. Simply type in the property address and let us do the rest!