Having an accurate accounting of your property’s net operating income (NOI)The revenue a property earns minus operating expenses, vacancy, and uncollectible receivables. The n... is essential when seeking a multifamily investment loan. The NOI represents the economic surplus generated by an income-producing property, such as an apartment complex, mobile home community, or a build-to-rent community. This information is critical for lenders who use underwriting metrics, including the debt service coverage ratio (DSCR)The DSCR is a tool used to underwrite a loan secured by an income producing property. The ratio is c..., to underwrite and size prospective loans.

The NOI Formula

The NOI formula is simple: NOI = real estate revenue – operating expensesOften referred to as “OpEx,” operating expenses refer to all costs necessary to operate and main.... However, it’s important to make this calculation as accurate as possible by including all sources of revenue and expenses before running the numbers.

Net rental income minus vacancy expenses will likely make up the bulk of property revenue. Also, keep in mind that the lenderThe person or party (such as a bank or corporate entity) that loans money on a commercial real estat... will assume a minimum of five percent vacancy for underwriting purposes. Other sources of property income may include parking, user and pet fees, storage spaces, service charges, ratio utility billings, and on-site services such as laundry or vending machines. For other commercial income such as an onsite billboard, the lender will also apply a minimum vacancy of five to 10 percent of the other commercial income. Operating expenses should cover all operational costs of the property, including property management fees, wages and salaries, hazard and liability insurance premiums, property taxes, utilities, repairs, and maintenance.

NOI and Underwriting Metrics Like DSCR

Lenders use NOI in various underwriting metrics such as DSCR to help underwrite loan risks and determine the loan balance, terms, and interest rate.

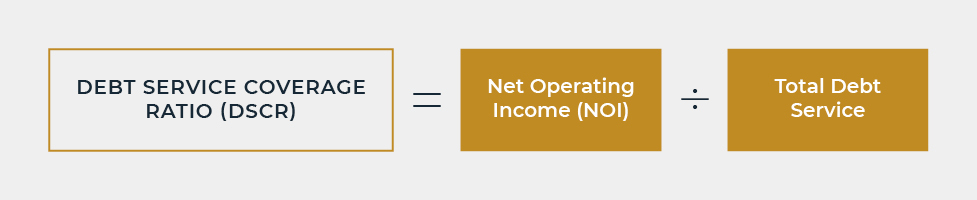

The DSCR Calculation

The DSCR calculation is: DSCR = NOI / total debt service. To summarize, larger DSCR ratios are more desirable for underwriting purposes, and lenders seek in almost all cases DSCRs greater than one—meaning that the property generates cash flow greater than the borrower’s periodic debt interest and principal obligations.

Depending on market, Freddie Mac SBL and Fannie Mae Small Loans require a minimum DSCR of 1.20. Other markets or loan structures can require a minimum DSCR of 1.40.

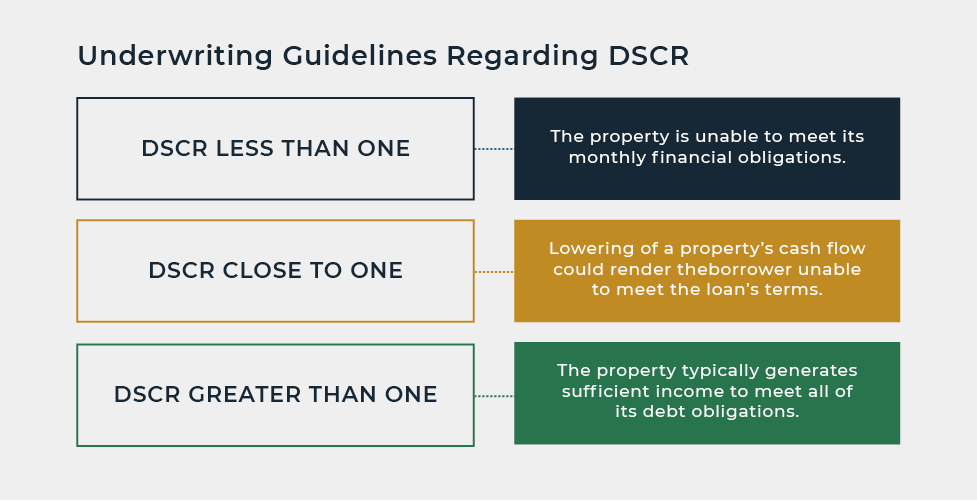

Some typical underwriting guidelines regarding DSCR include:

- DSCR less than one. The property is unable to meet its monthly financial obligations, requiring the borrower to use outside funding sources to prevent the loan from going into payment default. This situation will often prohibit a loan from being issued unless the borrower can prove it has access to the liquid assets necessary to make timely payment on the debt obligations.

- DSCR close to one. When the DSCR is calculated to be extremely close to one, this can also raise red flags for lenders. In these cases, a lowering of a property’s cash flow could render the borrower unable to meet the loan’s terms. To safeguard against this, some lenders make maintaining a DSCR of greater than one a condition of issuing the loan.

- DSCR greater than one. For DSCRs that are comfortably greater than one, this typically means that the property generates sufficient income to meet all of its debt obligations. These ratios often score the best terms and rates.

The above covers a few basic guidelines for interpreting a property’s DSCR, but every loan will be underwritten to its own unique circumstances. See your Lument representative for further details and to answer any questions you may have about NOI, DSCR, and other metrics underwriters consult when issuing a multifamily property loan.

Enter the address of your next opportunity to get instant insights including real time valuations, loan quotes and more.